Playtech DSR 2022

Our operations

B2B

Providing technology to gambling operators globally through a revenue share model and, in certain agreements, taking a higher share in exchange for additional services.

Revenue

€632m

EBITDA

€160m

EBITDA margin

B2C

Acting directly as an operator in select markets and generating revenues from online gambling, gaming machines and retail betting.

Revenue

€983m

EBITDA

€245m

EBITDA margin

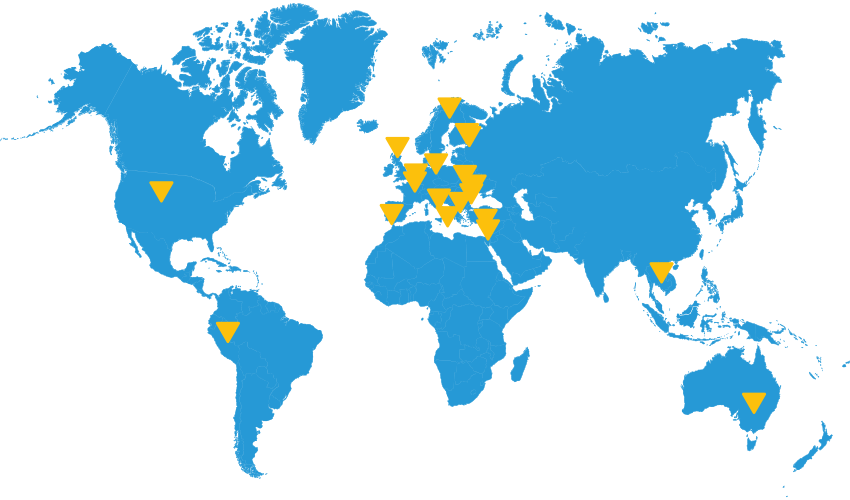

A global company

Playtech was established at the inception of the online gambling industry and possesses unparalleled knowledge and expertise in the sector, with over 20 years of experience and investment in technology. Playtech’s global scale and distribution capabilities, with over 180 licensees operating in over 40 regulated markets and with offices in 20 countries, mean we are ideally positioned to capture opportunities in newly regulating markets and high-growth markets with low online penetration.

Employees

c.7,000

Countries with offices

20

Regulated jurisdictions

>40

Product and Innovation

Award-winning technology delivering personalised solutions for operators and players

Through our proprietary technology solution, Playtech has pioneered omni-channel gambling technology which provides an integrated and open platform across retail and online for all key verticals, delivering a safe and seamless customer experience.

Highlights of the year

|

|

||||

|

|

1. From continuing operations.

2. B2B and B2C only.

3. Continuing operations but includes Finalto in FY20. Adjusted for Snaitech’s PREU tax payment of €90 million relating to 2020, which was paid in 2021 due to circumstances around COVID-19. Definition has changed from FY21 to adjust for changes in jackpot balances, client deposits and client equity, professional expenses on acquisitions and ADM security deposit.

B2B – executing on our strategy |

||||||||

|

|

|

||||||

B2C – outperforming and transformed |

||||||||

|

|

|

||||||

Building a better business |

||||||||

|

|

|

||||||

|

|

||||

|

|

1. From continuing operations.

2. B2B and B2C only.

3. Continuing operations but includes Finalto in FY20. Adjusted for Snaitech’s PREU tax payment of €90 million relating to 2020, which was paid in 2021 due to circumstances around COVID-19. Definition has changed from FY21 to adjust for changes in jackpot balances, client deposits and client equity, professional expenses on acquisitions and ADM security deposit.

B2B – executing on our strategy |

||||||||

|

|

|

||||||

B2C – outperforming and transformed |

||||||||

|

|

|

||||||

Building a better business |

||||||||

|

|

|

||||||

Review of the year

Chair's statement

"I am delighted to report another highly successful year for Playtech where we delivered strong growth and made significant progress against our strategy despite a challenging economic and geopolitical backdrop."

Chief Executive Officer's statement

"Playtech’s strong performance in 2022 was underpinned by the energy, enthusiasm and professionalism of the Company’s employees."

Chief Financial Officer's statement

"The excellent overall results in 2022 were driven by continued strength in the Group’s online businesses as well as retail reopening following pandemic-related closures in parts of 2021 in many of the Group’s markets."